The Truth About Down Payments

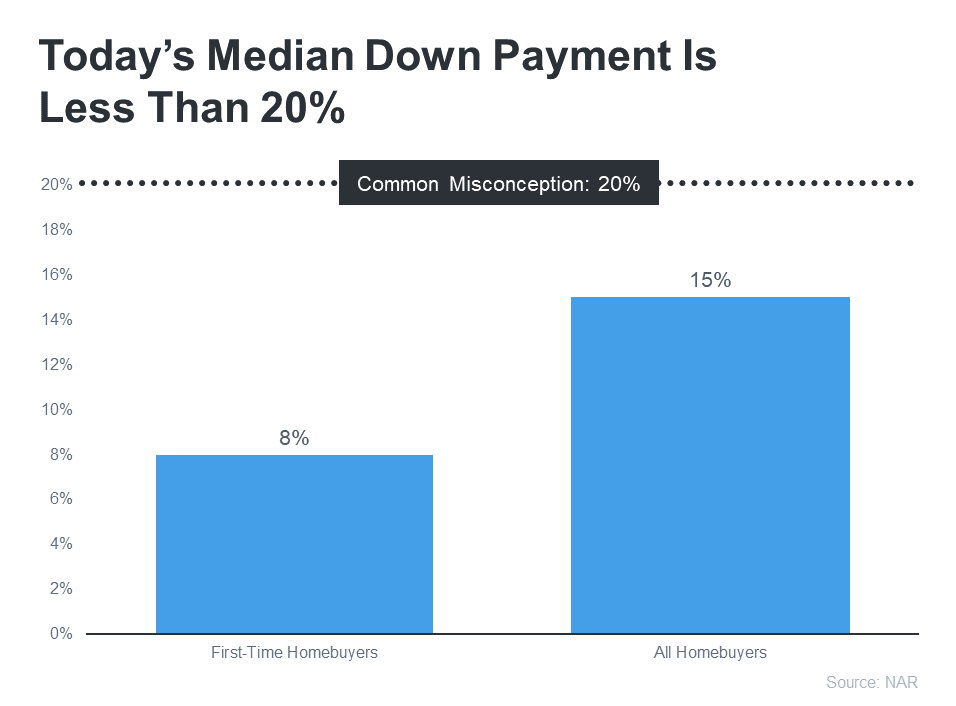

Thinking about purchasing your first home can be overwhelming, especially when considering the various costs involved, notably the down payment. Many believe that saving 20% of the home's price is a prerequisite, but this isn't necessarily accurate.

In reality, unless specified by your loan type or lender, there's typically no strict requirement to put down 20%. This means you might be closer to owning your dream home than you think.

Contrary to common belief, as highlighted by The Mortgage Reports, putting down 20% to avoid mortgage insurance isn't always necessary. In fact, most people opt for a much lower down payment.

According to data from the National Association of Realtors (NAR), the median down payment hasn't exceeded 20% since 2005. Presently, for all homebuyers, it's only 15%, and for first-time homebuyers, it's merely 8%.

The key takeaway? You may not need to save as much as initially anticipated.

Discover Available Resources to Assist You in Achieving Your Goal

Down Payment Resource reports that there are over 2,000 homebuyer assistance programs across the U.S., many of which aim to aid with down payments.

Moreover, various loan options can provide assistance. For instance, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for eligible applicants.

With numerous resources at your disposal to assist with your down payment, consulting with your loan officer or broker is the best way to explore what you qualify for. They are knowledgeable about local grants and loan programs that may benefit you.

Don't let the misconception that you need to have 20% saved up hinder your progress. If you're ready to embark on homeownership, rely on professionals to identify resources that can transform your dreams into reality. Waiting until you've saved up 20% may actually be costlier in the long run.

According to U.S. Bank, waiting to save up 20% for a down payment may consume too much time for some individuals. Meanwhile, as you're saving for your down payment and paying rent, the price of your future home may escalate.

Home prices are projected to continue appreciating over the next five years, implying that your future home's price will likely rise the longer you delay. Leveraging available resources to purchase now can enable you to capitalize on future price growth, thus helping you build equity instead of incurring additional costs.

In conclusion, remember that a 20% down payment isn't always necessary to buy a home. If you're considering making a move this year, initiate a discussion about your homebuying objectives with a reputable real estate professional.

Disclaimer: The information provided in this blog post is based on the latest available data at the time of writing, which is subject to change. It is intended for informational purposes only and should not be considered as financial or investment advice.