Will an Economic Downturn Tank the Housing Market?

If concerns about an imminent recession have been on your mind, you're not alone. There has been widespread discussion about the possibility of a recession in the past couple of years, with many expressing worries that it could lead to a significant increase in the unemployment rate, potentially causing a surge in foreclosures reminiscent of events 15 years ago.

However, the most recent Economic Forecasting Survey by the Wall Street Journal (WSJ) brings a shift in perspective. For the first time in over a year, fewer than half (48%) of economists anticipate a recession within the next year:

"There is a notable shift in optimism among economists regarding the U.S. economy... The probability of a recession within the next year, which averaged at 54% in July, has now decreased to a more positive 48%. This marks the first time in over a year that the probability has fallen below the 50% threshold."

With more than half of these experts no longer foreseeing a recession in the coming year, it follows logically that they also anticipate a more stable unemployment rate. The graph below utilizes data from the same WSJ survey to illustrate precisely what economists predict for the unemployment rate over the next three years (refer to the graph below):

If the predictions of these experts prove accurate, a greater number of individuals will find themselves unemployed in the approaching year. The impact of job losses, regardless of their nature, is profoundly distressing for those affected and their families.

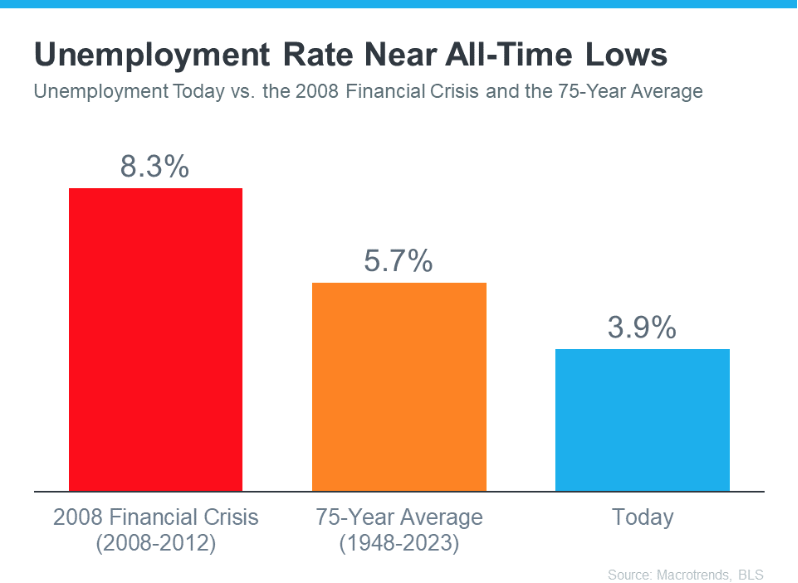

Yet, the pivotal question at hand is whether these job losses will be substantial enough to trigger a cascade of foreclosures, potentially leading to a collapse in the housing market. Drawing insights from historical data provided by Macrotrends and the Bureau of Labor Statistics (BLS), the answer appears to be in the negative. This is due to the fact that the current unemployment rate is hovering near its all-time lows, as depicted in the graph below:

As indicated by the orange bar in the graph, the historical average unemployment rate dating back to 1948 stands at 5.7%. In contrast, the red bar illustrates that during the immediate aftermath of the 2008 financial crisis, the average unemployment rate spiked to 8.3%. Notably, both of these historical averages surpass the current unemployment rate, represented by the blue bar.

Looking ahead, projections suggest that the unemployment rate is poised to remain below the 75-year average. Consequently, there is an expectation that we won't experience a surge in foreclosures significant enough to severely impact the housing market.

In summary, a majority of economists no longer anticipate a recession within the next 12 months. Consequently, they do not foresee a substantial increase in the unemployment rate, which would be a prerequisite for a wave of foreclosures leading to another housing market downturn. For inquiries regarding unemployment and its potential effects on the housing market, it is advisable to consult with a real estate professional.

Disclaimer: The information provided in this blog post is based on the latest available data at the time of writing, which is subject to change. It is intended for informational purposes only and should not be considered as financial or investment advice.