You Can Buy a Home Without Perfect Credit: Busting the Credit Score Myth

Many potential homebuyers aren’t on the sidelines because they’re not interested in buying — they’re there because they think they don’t qualify. And for a lot of people, credit score concerns are the biggest roadblock.

A recent Bankrate survey found that 42% of Americans believe you need excellent credit to get approved for a mortgage. That misconception shows up often when renters are asked why they haven’t bought yet — “my credit isn’t good enough” is one of the most common answers.

You might feel the same way. You check your credit score, realize it’s not perfect, and assume homeownership just isn’t in the cards right now.

Here’s the important part.

While many people believe you need near-perfect credit to buy a home, that simply isn’t always true.

You Don’t Need Perfect Credit to Become a Homeowner

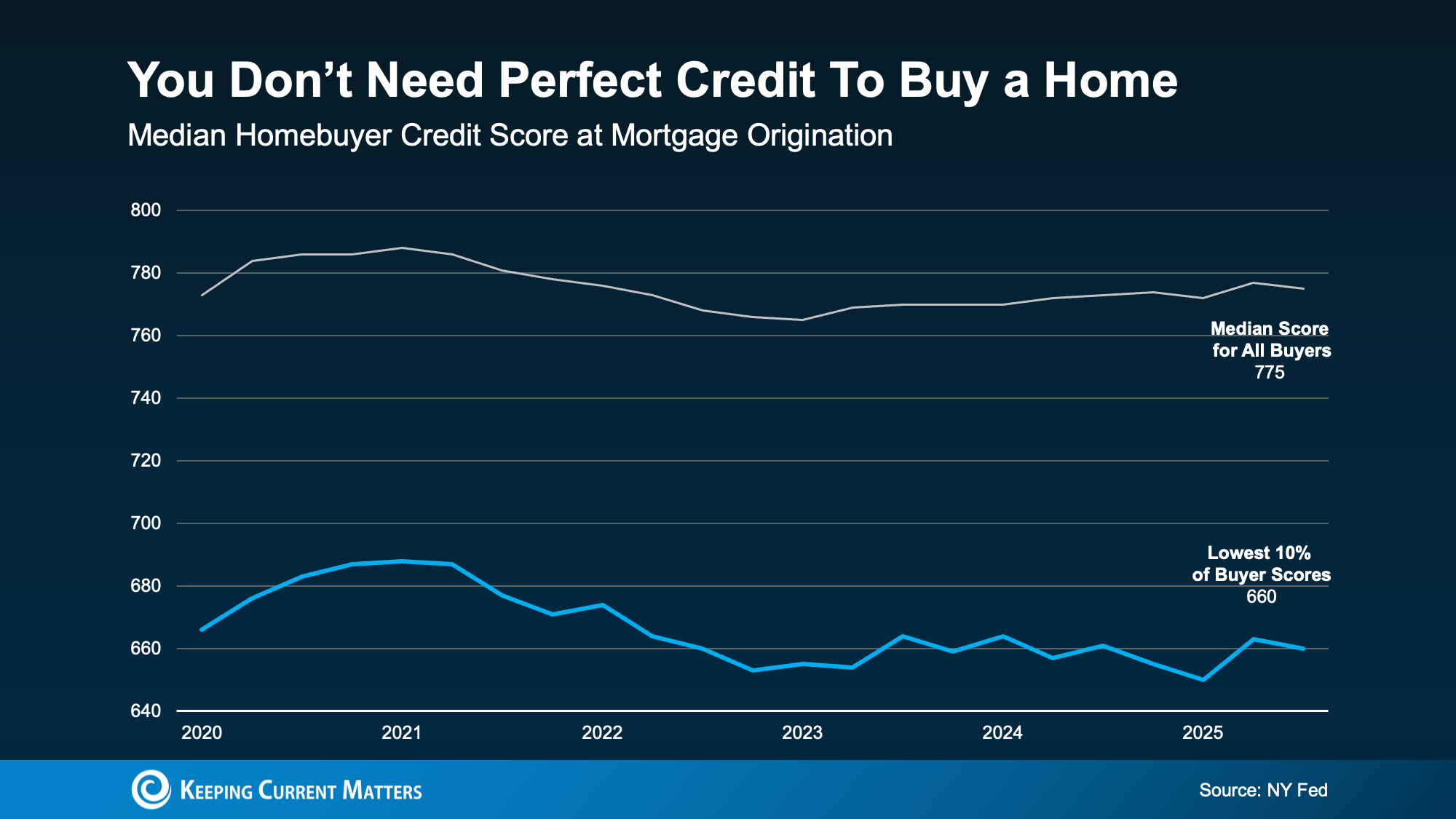

So where did this idea come from? A lot of the confusion comes from looking at today’s average homebuyer. According to data from the New York Fed, the typical buyer has a relatively strong credit profile, with a median credit score of about 775.

However, that number represents who is buying — not the minimum needed to qualify.

When you look closer at recent homebuyers, you’ll find that many successfully purchased a home with credit scores well below that level. In fact, data shows that roughly 10% of buyers had scores around 660. Some were higher, some were lower, but the midpoint of that group fell right in that range (see graph below).

Even if your credit score isn’t exactly where you want it to be, that doesn’t mean homeownership is off the table. According to FICO, there isn’t one specific credit score that automatically determines whether you can buy a home:

“While many lenders use credit scores like FICO Scores to help guide lending decisions, each lender follows its own criteria, including how much risk it’s willing to take. There is no single ‘minimum score’ required by all lenders, and many other factors are also considered…”

That’s why the smartest next step is simply to have a conversation with a knowledgeable lender who can walk through your options. Since many buyers are qualifying with credit scores in the 600s, you may be closer to buying than you realize.

Bottom Line

Your credit score matters — but it doesn’t have to be flawless.

If concerns about credit have kept you from moving forward, now may be a good time to revisit what’s actually possible. A quick conversation with a local lender can help you understand where you stand and what options may be available to you.

You don’t need all the answers before reaching out — sometimes the first conversation is simply about getting clarity.

Disclaimer: The information provided in this blog post is based on the latest available data at the time of writing, which is subject to change. It is intended for informational purposes only and should not be considered as financial or investment advice.